A deep dive into the CRE CLO ecosystem reveals a troubling surge in distress rates within this sector, marking a period of uncertainty and heightened scrutiny.

Collateralized Loan Obligations (CLOs) are financial tools that package loans, including those in the commercial real estate (CRE) market, into a variety of tranches that can be sold to investors. At the most basic level, they offer variable degrees of risk and return.

CRE CLOs had been an especially important investment vehicle for providing higher yields in the low-interest-rate environment of the past decade. The structure of CLOs might seem theoretically sound, but they also carry significant risks, especially for the higher yield tranches. These risks are often magnified in times of property vacancies or higher interest rates as we are experiencing now.

Rising delinquency rates and a mismatch between loan obligations and market demand have cast CRE CLOs in the role of a destabilizing force, exacerbating negative trends in an industry already navigating a complex set of challenges.

Key Takeaways

- CLOs bundle real estate loans to sell to investors, offering varied risks and returns.

- The commercial real estate market is experiencing amplified risks due to CLO dynamics.

- Current economic shifts are raising scrutiny of the stability that CLOs bring to CRE financing.

Understanding CLOs and Their Role in CRE Financing

CLOs are structured financial instruments that bundle together cash-flow-generating assets—specifically, loans—and sell tranches of those bundled loans to investors. These underlying loans could be corporate business financing products or loans made for a variety of real estate projects.

In the commercial real estate sector, they provide a mechanism for financing various projects by securitizing CRE loans with diverse risk profiles.

Mechanics of CRE CLOs

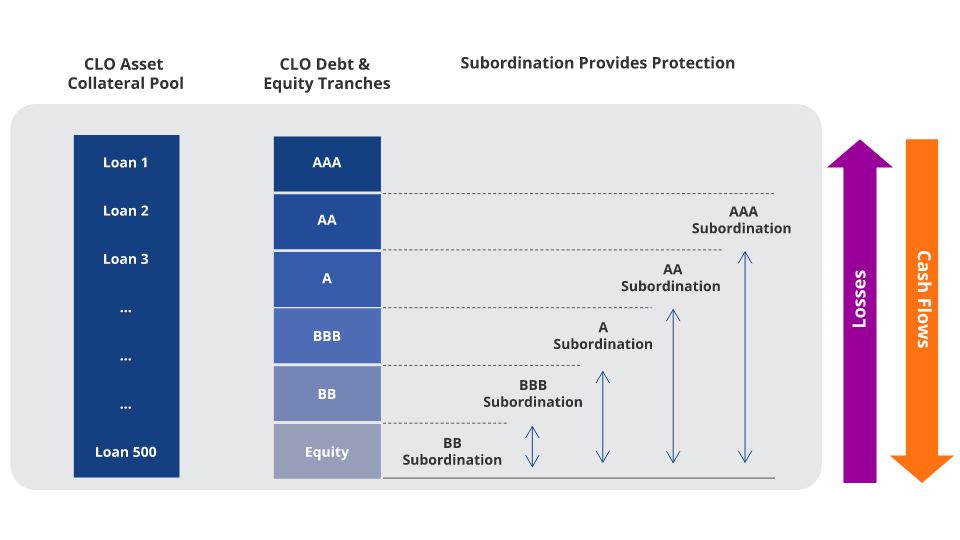

The process begins with CRE CLO managers purchasing a portfolio of loans and segregating them into tranches based on varying degrees of default risk. Investors choose tranches that align with their risk appetite.

Payments from the underlying loans are distributed to investors in a sequence. The sequence starts with the senior-most “AAA” tranches, which typically bear the lowest risk and the lowest interest rates, down to the “equity” tranches, which face the highest risk.

The highest-risk tranches have the potential to generate the highest yield from the CRE CLO investments. However, in times of distress, the payments and yields from these high-risk tranches are subordinated to the lower-risk senior tranches.

Regulatory Landscape and Structural Risks

CLOs are subject to regulatory scrutiny to ensure they do not contribute to systemic risk in the financial system. The regulation of CRE CLOs involves requirements for risk retention, transparency, and due diligence within the banking sector. These regulations aim at safeguarding the capital markets and maintaining the stability of the economy.

Banks are the primary investors in top-rated (AAA) Collateralized Loan Obligations (CLOs), and issuing a CLO is contingent on the sale of its AAA-rated portion. As a result, modifications to the capital requirements for banks can significantly influence the interest rate spreads of AAA CLOs. Additionally, it is only recently that non-institutional investors have gained access to this type of investment, thanks to the introduction of CLO Exchange-Traded Funds (ETFs).

Investing in CLOs carries risks such as default and bankruptcy of the underlying assets. Market shifts, including rising interest rates and economic downturns, can impact the performance of these securities. The 10-year treasury and federal funds rate are vital indicators of the cost of borrowing and can influence the economy and the attractiveness of CLOs.

Relationship to Other Investment Vehicles

While similar to mortgage-backed securities (MBS) in that both pool loans to create new securities, CLOs generally focus on commercial loans and allow for active management of the loan portfolio. The commercial real estate market, particularly since the pandemic, has added to the complexity of these instruments as they behave differently compared to other vehicles like mortgage-backed securities due to the varied nature of commercial premises and investment activity.

Overall Challenges in the CRE Market Accelerated by CLOs

The Commercial Real Estate (CRE) market is confronting a range of challenges exacerbated by Collateralized Loan Obligations (CLOs). Financial intricacies and market pressures tied to these instruments have cast a spotlight on underlying risk factors and changing dynamics across various sectors, including hospitality, retail, and office markets.

CLOs have contributed to elevated risk within the CRE market, particularly as higher office vacancy rates and a shift in retail enhance the likelihood of loan defaults. In the hospitality sector, the volatility of tourism and business travel directly affects occupancy rates and revenue, which in turn impacts the ability to service debt structured into CLOs. Additionally, an increase in property vacancies across commercial real estate sectors has led to fluctuations in CLO valuations, intensifying risk profiles for investors.

Strategic Default and Bankruptcy Cases

The CRE market has observed a rise in strategic defaults and bankruptcy filings, particularly within retail and hospitality assets facing liquidity crunches. These challenges, often driven by CLO-structured debts, place additional pressure on CRE developers and owners who are already grappling with changing consumer behavior and economic uncertainty. The office market isn’t immune either, with the shift toward remote work contributing to an increase in strategic defaults within this sector.

Investors in CLOs tied to the CRE sector are experiencing a squeeze on expected returns, amid rising construction costs and stringent deal flow. Developers, facing the dual challenges of slowed deal flow and steeper construction expenses, are finding it harder to forecast profitability and secure funding. Subsequently, this affects the real estate sector’s ability to attract and retain investment, given the heightened focus on risk assessment.

Specific Cases of CRE CLO Distress in the Current Market

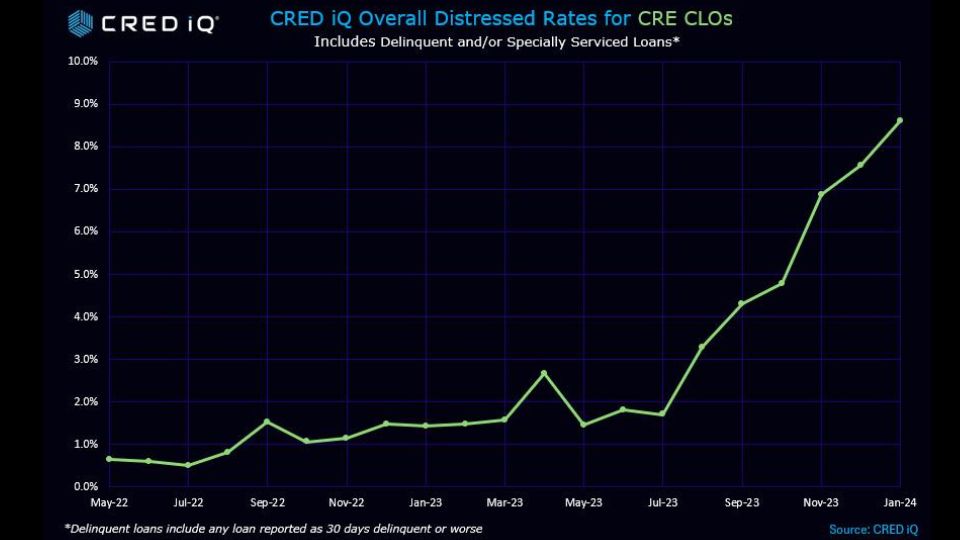

Recent analyses, particularly by research firm CRED iQ, have shone a spotlight on the growing distress rates in CRE CLOs. CRED iQ’s analysis has revealed a stark increase in the overall distress rate for CRE CLOs.

The distress rate climbed from 1.4% in early 2023 to a worrying 8.6% in January of 2024. This metric encompasses loans reported as 30 days delinquent or worse, as well as those under special servicer care. These elevated distress rates highlight the burgeoning pressure on CRE CLO performance.

Significance of Floating Rate Loans and Major Issuers

A substantial portion of the CRE CLO market is composed of floating rate loans, typically structured with three-year terms and equipped with extension options, contingent on meeting certain financial criteria.

Major issuers, including entities such as MF1, Arbor, and LoanCore, have been pivotal in the past five years, contributing significantly to the $80 billion in outstanding CRE CLO loans. This structure and the key players involved underscore the complexities and vulnerabilities inherent in the CRE CLO market.

The performance of loans within CRE CLOs has been notably affected by economic conditions such as cap rates, high valuations, and previously low interest rates. Many of these loans were originated in 2021, a period marked by favorable borrowing conditions. However, the recent spike in interest rates has led to maturity issues, reflecting the sensitive balance between economic forces and CRE CLO stability.

Loan-Level Performance and Distress Growth

In a striking demonstration of market volatility, the volume of distressed loans in CRE CLOs ballooned from $1.3 billion to over $6.8 billion within a year. This growth in distress levels, amounting to a more than 440% increase, underscores the dramatic shift in the CRE CLO landscape, highlighting the sector’s susceptibility to rapid changes in market conditions.

CREDiq highlighted the following specific cases in their analysis of the current CLO environment:

CRE CLO Office Loan

700 Louisiana and 600 Prairie Street is a 1,259,314-SF high-rise office property in downtown Houston, TX, backed by a $232.0M initial loan with a fully funded commitment of $252.0M. The interest-only loan failed to pay off at its September 2023 maturity date and has only been paid through September. The 56-story office tower was built in 1983 and renovated in 2011. The asset was appraised as-is at $403.0M at underwriting in June 2023 based on 66.7% occupancy as of April 2019. A 0.77 DSCR (NCF) and 65.8% occupancy were reported in the September 2023 financials. The largest tenant, TransCanada USA Pipeline, represents 23.0% of the net rentable area (NRA) with a lease scheduled to expire in February 2036. The remaining tenants each represent 4.0% or less of the NRA.

CRE CLO Multifamily Loan

An example of upcoming distress despite a “current” loan status is Caden at East Mil. The Caden at East Mill is a 768-unit multifamily property in Orlando, FL, backed by a $98.9M loan that was originated by Arbor. The loan is scheduled to mature in October 2024 with a fully extended maturity date in October 2026. The most recent financials from year-end 2022 reported a 0.65 DSCR (NCF), down from 1.56 at contribution in September 2021. The property was 96.2% occupied and valued at $120.1M in September 2021, at underwriting. Occupancy at the property fell to 85.6% as of November 2023.

Broad Impact of CRE CLOs on Commercial Real Estate Dynamics

Collateralized Loan Obligations (CLOs) have become a focal point in understanding shifts within the commercial real estate (CRE) market. With their complex interplay of investment strategies, lending practices, and economic forces, CLOs bear significant influence on the market dynamics.

Influence on Real Estate Valuations

CRE CLOs can directly affect real estate valuations. When their demand rises, the influx of capital into the CRE market often leads to an increase in property prices. Conversely, recent concerns about the sustainability of CRE CLOs and associated debt levels have contributed to more cautious valuation approaches, especially as some investors reevaluate the long-term viability of certain CRE assets, factoring in trends like e-commerce and remote work that are reshaping demands on commercial spaces.

Effects on Lending and Borrowing

Lending practices are inherently tied to the performance of CLOs. The availability and terms of CRE loans are influenced by the health of the CLO market. Increasing interest rates and a labor shortage have resulted in tighter lending conditions. This effect is more pronounced for property types that are more sensitive to economic cycles, such as retail and hospitality sectors, which means they may be more challenged to refinance as their maturities approach.

Commercial Real Estate Sectors Affected by CRE CLOs

Different commercial real estate sectors have been affected by the performance of CRE CLOs in varying degrees:

- Office spaces face an uncertain future with the shift toward remote and hybrid work, impacting investors’ willingness to engage in CLO-backed transactions.

- Retail has seen a notable impact from the rise of e-commerce, resulting in higher cap rates and a bearish outlook from investors.

- The hospitality industry is experiencing a double-edged sword from fluctuating travel demand and the implications of CLO-driven financing constraints.

- Multifamily properties generally maintain resilience, as housing demand remains strong. However, recent regional troubles have resulted in this asset class falling under increased scrutiny.

Frequently Asked Questions

What are the risks associated with Collateralized Loan Obligations in the Commercial Real Estate sector?

CLOs can pose various risks to the Commercial Real Estate sector, such as interest rate fluctuations and market instability during economic downturns, potentially leading to higher defaults and reduced investment returns.

How do CRE CLOs function within Commercial Real Estate financing?

Within commercial real estate financing, CLOs are structured financial instruments that bundle commercial loans, including real estate loans, and sell them as different tranches, offering varying risk levels to investors and facilitating liquidity in the real estate market.

What role does a CLO officer play in managing risks within the Commercial Real Estate market?

A CLO officer actively manages a portfolio of leveraged loans, including those tied to real estate, aiming to mitigate risks by overseeing loan selection, performance, and adherence to regulatory requirements within the market.

Can the strategy of using CRE CLOs to finance Commercial Real Estate lead to market instability?

If used excessively or without proper risk assessments, the strategy of using CLOs to finance Commercial Real Estate can contribute to market instability by increasing leverage and potentially leading to overvaluation of properties.

What are the implications of a downturn in CLO performance for the Commercial Real Estate industry?

A downturn in CLO performance can lead to tightening credit conditions, reduced liquidity, and lower property values, resulting in a challenging environment for the Commercial Real Estate industry.

How have recent developments in CLO markets affected commercial property investment?

Recent developments in CLO markets, such as changes in loan supply and investor demand, have affected commercial property investment by influencing financing availability and investment strategies within the real estate sector.