Data from July 2024 reveals a concerning trend: demand for raw materials and semi-manufactured goods has weakened at the fastest rate this year, signaling potential economic deceleration across major regions.

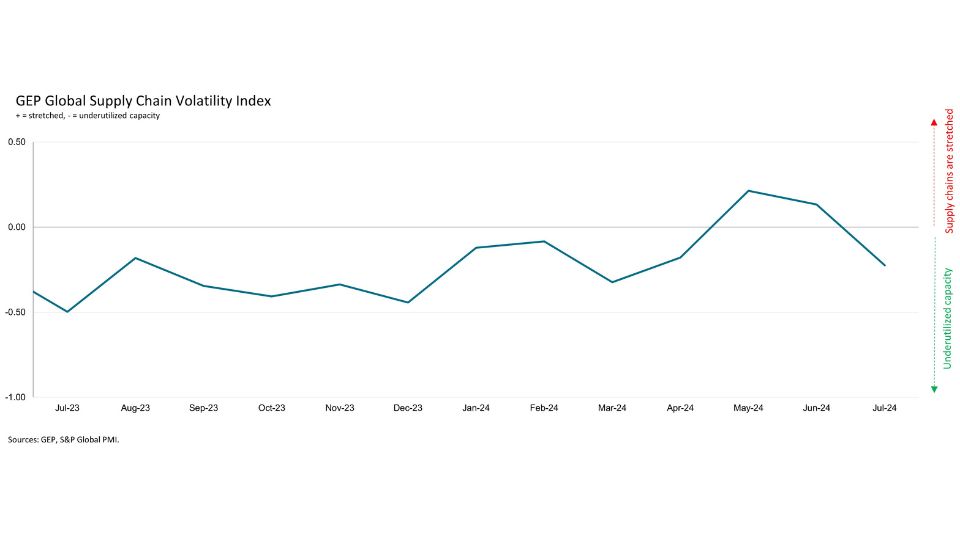

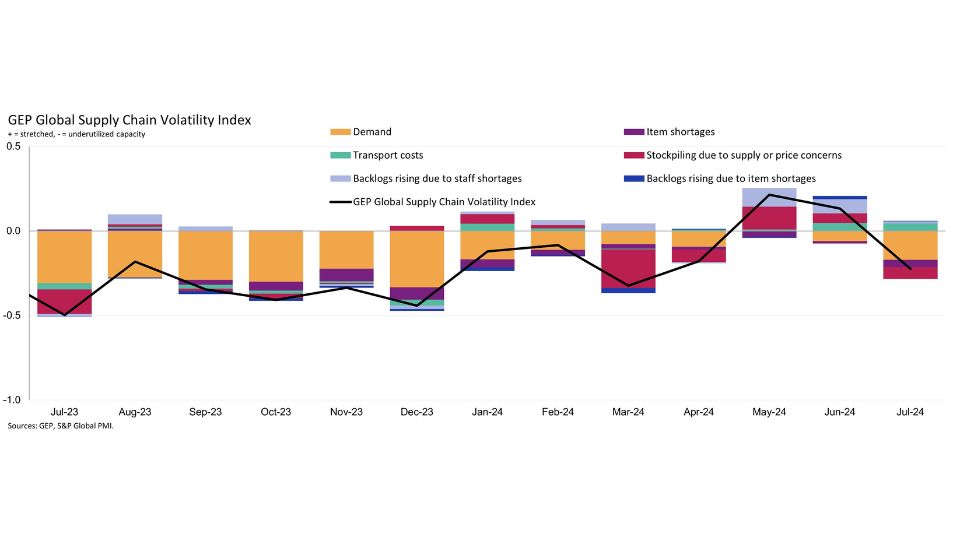

The GEP Global Supply Chain Volatility Index, derived from monthly surveys of 27,000 businesses worldwide, serves as a leading indicator of global supply chain health. It tracks key metrics such as demand conditions, shortages, transportation costs, inventories, and backlogs. The latest findings paint a picture of underutilized supply chain capacity, especially in regions like Asia and Europe, which are critical to global economic stability.

The Broader Economic Context

The report underscores the slowing momentum in Asian manufacturing, with factory demand dropping to its weakest level since December 2023. Notably, China, a key driver of global industrial activity, reported its first contraction in purchasing activity in nine months, reflecting deeper economic challenges. This drop in Chinese factory demand is not just a regional issue but a global one, given China’s significant role in global supply chains.

Japan, another industrial heavyweight, also saw a decline in manufacturing output, further dragging down the region’s overall performance. These developments are part of a broader trend of cooling global demand. This has been exacerbated by the ongoing geopolitical tensions, including the persistent trade frictions between China and the U.S.

In North America, the situation is similarly tenuous. Suppliers across the U.S., Mexico, and Canada reported slight underutilization of capacity, a sign that demand is softening. Particularly noteworthy is the decline in input demand from Mexican factories, a bellwether for the region, which had been on a growth trajectory since late 2023.

This decline marks a significant shift, as Mexico has been a critical supplier to North American manufacturers, particularly in sectors like automotive and electronics. These trends suggest that the robust economic recovery witnessed earlier in the year may be faltering, which could have broader implications for industries reliant on North American supply chains.

Europe, however, remains the most vulnerable. The region’s manufacturing sector continues to grapple with recessionary pressures, particularly in Germany, where factory purchasing activity contracted sharply. With the European economy heavily reliant on its manufacturing base, this persistent downturn poses significant risks to the broader global economy.

Germany, being the largest economy in Europe, is often seen as a barometer for the region’s economic health. The challenges faced by German manufacturers are emblematic of wider structural issues within the European Union, including high energy costs, labor shortages, and continued disruptions due to geopolitical tensions, particularly in relation to the Russia-Ukraine conflict.

Strategic Implications for Central Banks and Businesses

The weakening demand across key regions is adding to the growing calls for central banks, particularly the Federal Reserve, to reconsider their interest rate policies. The data suggests that supply chains are not currently under severe stress as there are no widespread shortages or significant price pressures. However, the underutilization of capacity could lead to a material slowdown in the latter half of 2024 and going forward into 2025.

This potential downturn is particularly concerning given the ongoing geopolitical and economic challenges, such as the Russia-Ukraine conflict, which has already strained supply chains, especially in Europe. The energy crisis in Europe, driven by the continent’s reliance on Russian gas, has exacerbated these issues, leading to higher production costs and further squeezing margins for manufacturers.

Central banks are increasingly focused on supply chain dynamics as a key factor influencing inflation. The potential for supply-driven inflation remains a concern, especially if demand does not pick up. As a result, central bankers may need to balance the risks of tightening monetary policy further with the need to support economic activity.

The Federal Reserve, for example, might face pressure to lower interest rates sooner rather than later to avoid exacerbating the slowdown. However, wIth the US national debt now exceeding $35 Trillion, reducing interest rates on long-term government bonds could dampen investor appetite for further funding of persistent US fiscal deficits.

In Europe, the European Central Bank is facing similar dilemmas, particularly as inflation remains stubbornly high in many member states, despite the ongoing economic slowdown.

For businesses, the current environment underscores the importance of flexibility and resilience in supply chain management. Companies must be prepared for continued disruptions, whether from labor strikes, geopolitical tensions, or climate-related events.

The need for more agile logistics, diversification of supply sources, and robust risk management strategies has never been more critical. Businesses are increasingly looking at digitalization and automation as ways to build more resilient supply chains. These technologies can help companies better manage inventory, anticipate disruptions, and optimize transportation routes, which are essential in a time of heightened uncertainty.

Related: Explore the Top 5 Business Financing Trends in 2024 & Beyond

Looking Ahead: A Year of Challenges and Adjustments

The remainder of 2024 is likely to be marked by ongoing challenges for global supply chains. Transportation costs, particularly in Asia, remain elevated, and the risk of further disruptions cannot be discounted.

The geopolitical landscape, especially tensions between China and the U.S., will continue to pose risks to global trade flows, particularly in high-tech sectors reliant on semiconductors and other critical components. Any escalation in these tensions could further disrupt supply chains, particularly those involving cross-border trade of sensitive technologies.

Moreover, the ongoing energy crisis in Europe, driven by the region’s reliance on Russian gas, is likely to keep manufacturing under pressure. With energy prices high and labor shortages persisting in key sectors like logistics and warehousing, businesses in Europe face a tough operating environment.

While global supply chains are not in crisis mode yet, the signs of slowing demand and underutilization of capacity suggest that economic growth is at risk. Central banks and businesses alike will need to navigate these uncertainties carefully to avoid a deeper downturn. As the Global Supply Chain Volatility Index continues to track these developments, its insights will be invaluable for policymakers and industry leaders trying to steer through this highly challenging period.