mBridge is a groundbreaking project that aims to revolutionize cross-border payments using digital currency. For more than three years, the Bank of International Settlements (BIS) and the central banks of China, Hong Kong, Thailand, and the United Arab Emirates (UAE) have been collaborating on this cross-border central bank digital currency (CBDC) initiative.

The project seeks to enhance the efficiency, speed, and transparency of international transactions, addressing the challenges posed by traditional correspondent banking systems.

Recently, mBridge took an important step forward with the completion of its minimal viable product (MVP) stage and the decision by Saudi Arabia to join the project. This collaboration not only strengthens financial ties between China, Saudi Arabia, and the UAE but also aligns with the broader efforts of BRICS nations to explore digital currency solutions like BRICS Pay.

Background of the mBridge Project

The mBridge project was the brainchild of the central banks of China, Hong Kong, Thailand, and the UAE. It gradually moved forward with the support of the Bank of International Settlements (BIS).

The primary objective of mBridge is to improve the efficiency, speed, and transparency of cross-border payments by utilizing a purpose-developed permissioned distributed ledger technology (DLT) known as the mBridge ledger (mBL). This technology supports instant peer-to-peer and atomic cross-border payments and foreign exchange (FX) transactions using wholesale Central Bank Digital Currencies (CBDCs).

Atomic transactions are transactional actions where a set of actions is treated as one atomic, connected event. These are the transactions that can be completed entirely or rolled back completely in case of failure, so as to ensure data consistency and reliability.

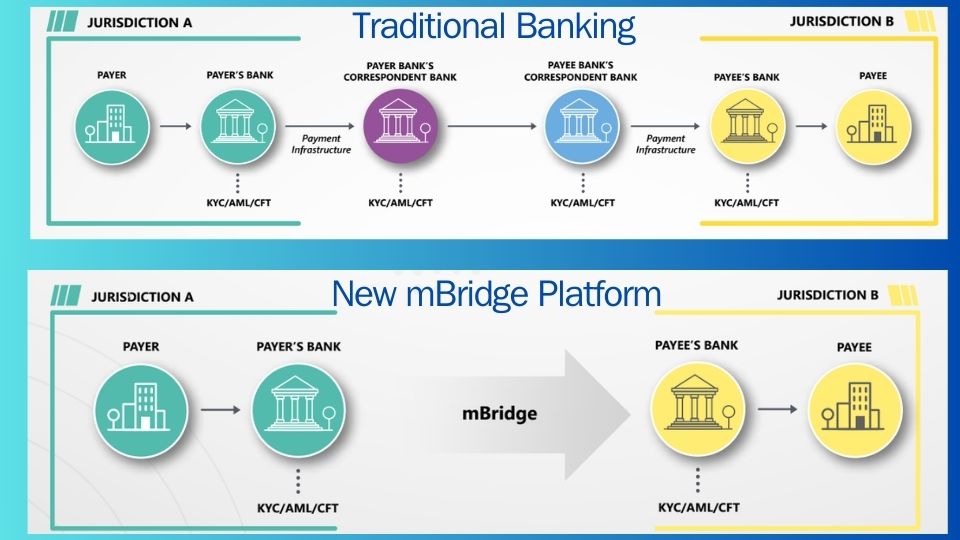

Traditional correspondent banking systems involve multiple intermediaries, leading to high transaction costs, slow processing times, and a lack of transparency. By leveraging blockchain technology, the mBridge project aims to streamline cross-border payments, reduce costs, and enhance the overall efficiency of international financial transactions.

The Need for Revolutionizing Cross-Border Payments

Traditional correspondent banking often results in delays and increased costs, making it less efficient for businesses and individuals engaged in international trade.

Digital currencies, particularly CBDCs, offer a promising solution to these issues. By enabling direct transactions between central banks, CBDCs can eliminate the need for intermediaries, reducing transaction costs and speeding up processing times. Additionally, the transparency provided by blockchain technology ensures that all transactions can be tracked in real time, reducing the risk of errors and enhancing trust among participating entities.

For instance, a business in the UAE importing goods from China would typically face high transaction fees and delays due to the involvement of multiple banks and intermediaries. With the mBridge project, this business could execute the payment directly to the supplier in China using a digital currency, thereby saving on fees and ensuring a faster transaction.

How the mBridge Project Works

The mBridge project utilizes a permissioned distributed ledger technology called the mBridge ledger (mBL) to facilitate cross-border transactions. This blockchain-based infrastructure ensures that all transactions are secure, transparent, and immutable, providing a reliable platform for international payments.

The process of a cross-border transaction using mBridge involves several key steps. Following up on our example of a UAE company importing goods from China the following steps would take place:

- Initiation: The business in the UAE initiates a payment to the supplier in China using the mBridge platform.

- Verification: The transaction is verified by the blockchain network, ensuring that the sender has sufficient funds and that the transaction is legitimate.

- Recording: Once verified, the transaction is recorded on the mBridge ledger, where it is visible to both the sender and the recipient.

- Completion: The supplier in China receives the payment, and the transaction is marked as complete on the blockchain.

This streamlined process eliminates the need for multiple intermediaries, reduces transaction fees, and ensures faster completion times. The use of atomic transactions ensures that both the payment and the corresponding foreign exchange transaction are completed simultaneously, reducing the risk of settlement failures.

Collaboration Between China and the UAE

The economic partnership between China and the UAE has grown significantly over the years, with both countries recognizing the potential benefits of closer financial integration. The mBridge project fits seamlessly into the broader economic strategies of both nations, which aim to enhance trade relations and foster technological innovation.

For China, the project aligns with its Belt and Road Initiative (BRI), which seeks to enhance global trade connectivity. For the UAE, the project supports its vision of becoming a leading global hub for technology and finance. The mutual benefits of the mBridge project include increased trade volumes, stronger financial ties, and enhanced economic cooperation.

Involvement of Other BRICS Nations

The BRICS group, comprising Brazil, Russia, India, China, and South Africa, has collectively shown interest in exploring digital currency solutions to enhance economic cooperation and reduce dependency on traditional financial systems dominated by Western countries. The BRICS Pay initiative, for instance, aims to create a unified payment system that facilitates seamless transactions among member states.

Recently, BRICS announced its expansion to include six new members: Saudi Arabia, Iran, Ethiopia, Egypt, Argentina, and the United Arab Emirates. This expansion, effective January 1, 2024, significantly increases the economic and demographic clout of the BRICS bloc, bringing the total population represented by BRICS to about 46% of the world’s population and enhancing its share of global GDP and trade,

The arrival of Saudi Arabia to mBridge represents an interesting turn of events. On the one hand, it shows the deepening of Riyadh’s relationship with China given Beijing’s dominant role in the initiative. On the other, it boosts the credibility of the project considering Saudi Arabia’s importance as an oil exporter. The Kingdom possesses roughly 17% of the world’s petroleum reserves and is one of the largest net exporters of petroleum.

One possibility now that Saudi Arabia has joined mBridge is that the platform will be increasingly used for commodity settlement that bypasses the U.S. dollar. In November 2023, the People’s Bank of China and the Saudi Central Bank signed a local currency swap agreement worth RMB 50 billion ($6.9 billion). In December 2022, Chinese President Xi Jinping told Gulf Arab leaders that Beijing would work to buy oil and gas in renminbi, but as of last November, it had not yet used the currency for Saudi oil purchases.

The inclusion of these new members underscores the strategic importance of the mBridge project and similar initiatives within the expanded BRICS framework. For instance, BRICS nations could integrate their digital currency projects to create a more cohesive and efficient payment system that supports intra-BRICS trade. The mBridge project could potentially influence the development and implementation of BRICS Pay, highlighting the benefits of blockchain technology in facilitating cross-border transactions.

Potential Impacts on Global Finance

The successful implementation of the mBridge project could have far-reaching implications for global finance. By demonstrating the feasibility and benefits of blockchain-based cross-border payments, the project could set a precedent for other countries to adopt similar solutions. This could lead to a more decentralized and efficient global financial system, where digital currencies play a significant role in facilitating international trade.

Moreover, the mBridge project could encourage further innovation in financial technologies, as other countries and financial institutions look to replicate its success. The increased efficiency and transparency of cross-border payments could also boost global trade, providing economic benefits on a broader scale.

The new CBDC settlement mechanism across borders will help countries perform international trade in their own currencies instead of having to use a trade currency of a third country. This will further reduce the need for countries to stock up on huge reserves of the currently dominant trade currencies (i.e., USD, EUR, etc.), which makes them dependent on moving money through the banks of the USA or Europe.

This dependency not only increases costs but also makes trading countries vulnerable to the rules and regulations of the third country. For instance, a trade between Saudi Arabia and India would typically need to comply with the rules of the USA if it were conducted in U.S. dollars.

Challenges and Future Prospects

Despite its promising potential, the mBridge project faces several challenges. Regulatory hurdles are among the most significant, as different countries have varying regulations regarding digital currencies and blockchain technology. Ensuring compliance with these regulations while maintaining the efficiency and security of the mBridge platform will be crucial.

Technological challenges also exist, particularly in terms of scalability and interoperability. As more transactions are processed through the mBridge platform, ensuring that the blockchain can handle increased volumes without compromising performance will be essential. Additionally, integrating the mBridge platform with existing financial systems in both China and the UAE will require careful planning and execution.

Looking forward, the future of digital currency in cross-border payments appears promising. The mBridge project represents a significant step in this direction, but continued innovation and collaboration will be necessary to fully realize the potential of digital currencies. As other BRICS nations and global financial institutions observe the progress of mBridge, they may be inspired to develop similar initiatives, further driving the adoption of digital currencies in international finance.

Looking Ahead: mBridge’s Potential for Global Expansion

The mBridge project stands as a pioneering effort by China, the UAE, and other participating countries to revolutionize cross-border payments using digital currency. By leveraging blockchain technology, the project aims to address the inefficiencies and high costs associated with traditional cross-border transactions. The collaboration between these nations, along with the potential involvement of other BRICS countries and the newly expanded members, underscores the growing importance of digital currencies in global finance.

As the mBridge project progresses, it has the potential to set a new standard for cross-border payments, encouraging other countries to adopt similar solutions. While challenges remain, the future of digital currency in international trade looks promising, with the mBridge project leading the way toward a more efficient and transparent global financial system.

According to the BIS, as of June 2024, the observing members of Project mBridge include:

Asian Infrastructure Investment Bank, Bangko Sentral ng Pilipinas; Bank Indonesia; Bank of France; Bank of Israel; Bank of Italy; Bank of Korea; Bank of Namibia; Central Bank of Bahrain; Central Bank of Chile; Central Bank of Egypt; Central Bank of Jordan; Central Bank of Malaysia; Central Bank of Nepal; Central Bank of Norway; Central Bank of the Republic of Türkiye; European Central Bank; International Monetary Fund; Magyar Nemzeti Bank; National Bank of Cambodia; National Bank of Georgia; National Bank of Kazakhstan; New York Innovation Centre, Federal Reserve Bank of New York; Reserve Bank of Australia; South African Reserve Bank; and World Bank.