In the ever-evolving world of finance, tokenization has carved out a significant niche, capturing the attention of giant investment companies, cutting-edge technologists, and wary regulators alike. As digital currencies gain traction, this transformative concept is emerging as a significant development in the digital currency space. Tokenization involves creating digital representations of real-world assets on blockchain platforms, promising to revolutionize the way we understand and interact with ownership and investment.

What is Tokenization?

Tokenization is the process of converting ownership rights of an asset into a digital token on a blockchain. In essence, it transforms physical and non-physical assets into digital tokens that can be bought, sold, and traded on various blockchain platforms. These tokens are secured by cryptographic algorithms, ensuring the integrity and authenticity of the ownership records.

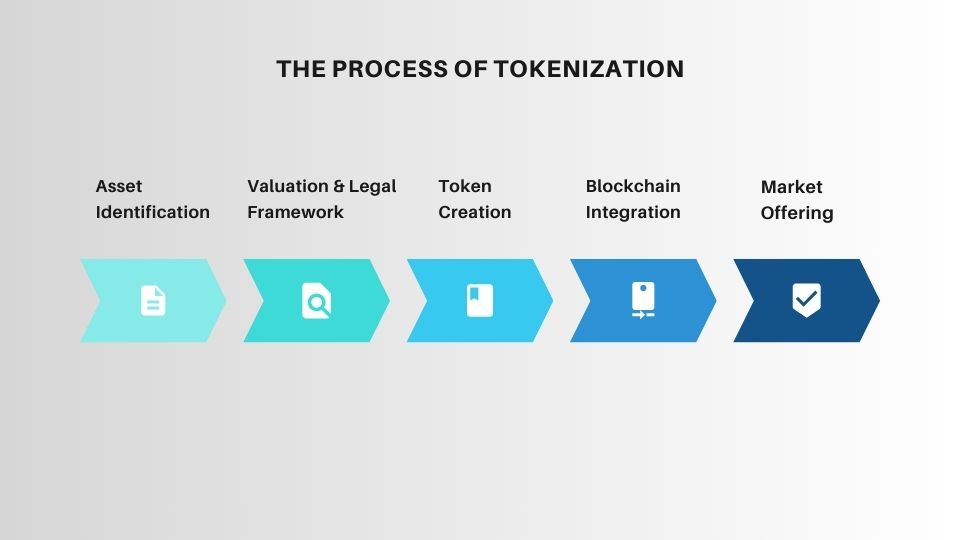

The Process

The process of tokenization involves several key steps:

- Asset Identification: The asset to be tokenized is identified, whether it be real estate, art, commodities, or other valuable items.

- Valuation and Legal Framework: The asset is valued, and a legal framework is established to define the rights and obligations of token holders.

- Token Creation: Digital tokens are created to represent the ownership or rights of the asset. Each token typically represents a fraction of the total value of the asset.

- Blockchain Integration: The tokens are issued on a blockchain platform, leveraging its decentralized and transparent nature to ensure secure and verifiable transactions.

- Market Offering: The tokens are made available to investors, who can purchase them through various digital currency exchanges or platforms.

Types of Assets

Tokenization is not limited to a specific category of assets. It can encompass a wide range of real-world items, including:

- Real Estate: Properties, both residential and commercial, can be tokenized to allow fractional ownership.

- Commodities: Physical commodities like gold, silver, oil, and agricultural products can be tokenized, facilitating easier trading and investment.

- Financial Instruments: Stocks, bonds, and other financial instruments can be represented as tokens, enhancing liquidity and accessibility.

- Art and Collectibles: High-value artworks and collectibles can be tokenized, enabling broader access to these typically illiquid markets.

Tokenization, therefore, serves as a bridge between the tangible world and the digital financial ecosystem, offering a modern form of ownership and investment.

Digitization Continues to Transform Traditional Industries

The old adage, “How do you eat an elephant? One piece at a time,” applies well to real asset tokenization. This approach allows large asset values to be divided into smaller, more manageable parts, making them accessible to a broader group of investors. As a result, the market for these large asset classes becomes more liquid, offering higher potential returns for smaller investors.

From a technological standpoint, my experience in the commercial real estate and banking industries has shown me the significant benefits of integrating continuous digital advancements into these traditional sectors.

For instance, loan files for larger assets used to involve stacks of documentation. Sometimes the amount of paperwork was so much that one of our loan files needed to be stacked all the way up to the ceiling. Fortunately, the digitization of real estate financial documents revolutionized this process, enabling far more efficient operations in banking loan departments worldwide.

Similarly, recent digital innovations now facilitate lightning-fast execution of complex real estate transactions. This includes the ability to sell underlying assets, such as real property or loan portfolios, through tokenization, further streamlining and enhancing the efficiency of these processes.

Benefits of Tokenization

Tokenization brings a multitude of benefits that have the potential to transform the traditional financial landscape, making it more inclusive, efficient, and secure.

Increased Liquidity

One of the most significant advantages of tokenization is its ability to enhance liquidity for traditionally illiquid assets. Real estate, fine art, and certain commodities often face challenges in finding buyers quickly due to their high value and indivisibility. Tokenization breaks these assets into smaller, more manageable units that can be traded more easily, thereby increasing market liquidity and making it easier for asset owners to convert their holdings into cash.

Fractional Ownership

Tokenization allows for fractional ownership, meaning that multiple investors can own a fraction of an asset rather than the whole. This democratizes access to high-value assets, enabling smaller investors to participate in markets that were previously out of reach. For example, an investor can own a fraction of a commercial property or a piece of art without needing to purchase the entire asset. This not only diversifies investment portfolios but also spreads risk among multiple investors.

Transparency and Security

Blockchain technology underpins tokenization, bringing inherent transparency and security to the process. Every transaction involving tokenized assets is recorded on a blockchain, creating an immutable and transparent ledger. This reduces the risk of fraud and enhances trust among investors. Additionally, smart contracts can automate and enforce the terms of transactions, further ensuring security and compliance with predetermined rules.

Efficiency and Cost Reduction

Traditional processes for buying and selling assets can be cumbersome and costly, involving numerous intermediaries, paperwork, and lengthy settlement times. Tokenization streamlines these processes by leveraging blockchain technology to facilitate faster and more efficient transactions. This reduction in intermediaries and administrative overhead leads to significant cost savings for both buyers and sellers.

Challenges and Risks

While tokenization offers promising benefits, it also presents several challenges and risks that must be addressed to ensure its successful adoption and integration into the broader financial system.

Regulatory Hurdles

Regulation remains one of the most significant challenges for the tokenization of real-world assets. Different jurisdictions have varying laws and regulations regarding digital assets, and there is often a lack of clarity and consistency in how these regulations are applied. Ensuring compliance with local and international laws is crucial to prevent legal issues and to protect investors. Regulatory bodies are gradually catching up, but the evolving nature of blockchain technology means that regulatory frameworks need constant updates and adaptations.

Technological Risks

While blockchain technology offers robust security features, it is not immune to risks. Cybersecurity threats, such as hacking and data breaches, pose significant risks to tokenized assets. Additionally, issues related to blockchain scalability and interoperability can affect the efficiency and reliability of tokenization platforms. As the technology evolves, continuous improvements and innovations are necessary to mitigate these risks and ensure the resilience of tokenized asset platforms.

Market Adoption

The success of tokenization depends heavily on market adoption by both investors and asset owners. Building trust and confidence in this new financial paradigm is a considerable challenge. Investors may be hesitant to invest in tokenized assets due to unfamiliarity with the technology and concerns about market volatility. Similarly, asset owners may be reluctant to tokenize their assets due to the perceived complexity and potential risks involved. Education and awareness campaigns, along with successful case studies, are crucial in driving wider adoption.

Addressing these challenges requires a concerted effort from industry stakeholders, including technology developers, regulators, and market participants. By navigating these hurdles, the full potential of tokenization can be realized, unlocking new opportunities and efficiencies in the financial markets.

Tokenization is not the Answer to Market Fluctuations

Although tokenization is an exciting prospect for many investors, the fundamental rules of markets still apply. For example, with tokenization investors can more easily acquire fractional ownership interests in commercial or residential properties. However, this transactional ease does not erase the fact that property values can go up and, very importantly, they can decline. The 2008-2010 financial crisis was a vivid example of the potential for real-world assets to experience severe drops in value.

Therefore, it is incumbent on investors to understand the valuation models of the tokenized assets that they are buying. The fact that one can now purchase a smaller portion of a real-world asset does not negate market forces affecting the value of that asset.

Case Studies

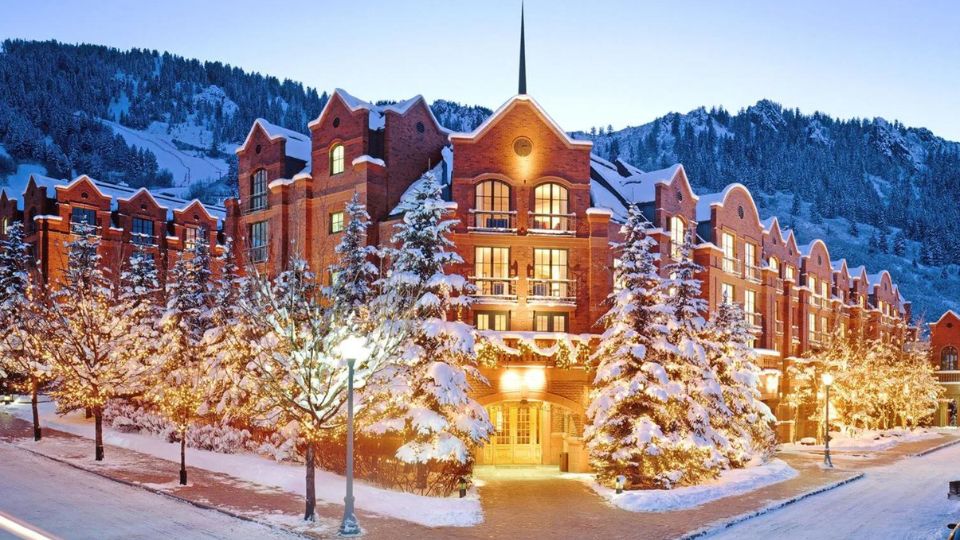

Real Estate

One of the most prominent examples of tokenization in real estate is the St. Regis Aspen Resort in Colorado. In 2018, the luxury hotel was tokenized and offered as a digital security to investors. The ownership group behind the St. Regis Aspen announced the sale of 18.9 percent of the resort through $18 million in digital tokens. Using blockchain technology, the property was divided into digital tokens, each representing a share of ownership in the resort.

These tokens, sold at $1 each through a real estate offering called Aspen Digital, were available only to accredited investors willing to purchase at least 10,000 tokens. This allowed investors to purchase fractional ownership in a high-value asset that would otherwise require substantial capital. The tokenization of St. Regis Aspen demonstrated how real estate assets could be made more accessible and liquid, attracting a broader range of investors and increasing the flexibility of real estate investments.

Financial Products

Infineo has made a notable advancement in the life insurance industry by executing the first tokenized life insurance policy on the Provenance Blockchain. This development leverages blockchain technology to convert life insurance policies into digital assets, which can be easily managed, transferred, and traded. The Provenance Blockchain ensures that all transactions and policy details are securely and transparently recorded, providing a reliable and verifiable system. This move aims to enhance the transparency and efficiency of life insurance policies while making them more accessible to a wider range of investors.

The tokenization of life insurance policies by Infineo represents a significant step toward modernizing the insurance sector. This approach offers policyholders increased liquidity, allowing them to fractionalize and sell their policies on secondary markets, thus providing greater financial flexibility. Additionally, blockchain technology helps to reduce administrative costs and eliminates the need for intermediaries, resulting in more streamlined operations. Infineo’s initiative highlights the potential of blockchain technology to transform traditional financial services, setting a new precedent in the life insurance industry.

Commodities

The Tether Gold (XAUT) token represents a significant advancement in the tokenization of physical assets, allowing investors to hold digital assets backed by physical gold. Each XAUT token is equivalent to one fine troy ounce of gold, securely stored in a Swiss vault. As of the latest data, Tether Gold is trading at approximately $2,387 per token, with a market cap of around $588.55 million and a circulating supply of 246,524 XAUT tokens. This tokenization process provides the stability and value retention of gold while offering the flexibility and accessibility of digital assets.

Tokenizing gold offers several advantages over traditional gold investment. XAUT tokens can be traded 24/7 on various cryptocurrency exchanges, providing liquidity and ease of transfer that physical gold cannot match. Investors can buy, sell, and trade these tokens quickly and efficiently without the need for intermediaries. Additionally, owning XAUT tokens eliminates the challenges associated with storing and securing physical gold. This combination of liquidity, security, and convenience makes Tether Gold a compelling option for investors looking to diversify their portfolios with digital assets backed by a historically stable commodity

Tokenization Market Estimates – $2 Trillion by 2030

McKinsey’s recent study on asset tokenization highlights significant advancements and the future potential of tokenized assets in the financial sector. The study emphasizes the transformative benefits of tokenization, such as improved capital efficiency, democratization of access, operational cost savings, and enhanced compliance and transparency. For instance, tokenization can streamline operational processes and reduce settlement times from the current T+2 days to mere minutes, which is particularly advantageous in high-interest-rate environments. This could lead to substantial savings for investors and financial institutions.

The current market for tokenized cash has reached approximately $120 billion, primarily through fully reserved stablecoins like USD Coin, with stablecoin on-chain volumes regularly exceeding $500 billion monthly. McKinsey anticipates that by 2027, tokenization could be widely adopted across various asset classes, significantly enhancing market efficiency and liquidity.

Despite these promising benefits, the study also outlines the challenges hindering widespread adoption. Key obstacles include the current limitations of blockchain technology, high implementation costs, regulatory uncertainties, and a need for industry alignment. The infrastructure required for large-scale tokenization is still developing, with issues such as fragmented blockchain ecosystems and inadequate institutional-grade custody solutions.

Additionally, the regulatory framework remains inconsistent across regions, posing further barriers. While tokenized assets offer potential operational cost savings, the short-term business case remains challenging due to the high costs of adapting existing middle- and back-office workflows. However,

McKinsey projects that by 2030, advancements in technology, regulatory clarity, and industry alignment will overcome these challenges, leading to the mainstream adoption of tokenized assets. In their base case estimate, McKinsey concludes that the market for tokenized assets could reach $2 trillion by 2030

Future Prospects

Innovations on the Horizon

The future of tokenization holds immense promise, with numerous innovations on the horizon. Advances in blockchain technology, such as improved scalability and interoperability, will enhance the efficiency and usability of tokenized assets. Additionally, the integration of artificial intelligence and smart contracts will further automate and optimize the management of tokenized assets. These innovations will make the process more seamless, secure, and attractive to investors and asset owners alike.

Integration with Financial Systems

As tokenization continues to evolve, there is significant potential for integration with traditional financial systems and institutions. Major financial players are increasingly exploring blockchain and tokenization technologies to enhance their offerings and operations. For instance, investment banks and asset management firms are developing platforms to facilitate the trading and management of tokenized assets. This integration will bridge the gap between traditional finance and the emerging digital asset ecosystem, creating a more cohesive and efficient financial system.

Impact on Global Markets

The widespread adoption of tokenization is poised to have a profound impact on global financial markets. By increasing liquidity, reducing transaction costs, and democratizing access to high-value assets, tokenization can drive greater financial inclusion and economic growth. It can also enhance transparency and trust in financial transactions, fostering a more secure and efficient market environment. As more assets are tokenized and integrated into global markets, the potential for innovation and growth in the financial sector will continue to expand, unlocking new opportunities for investors and asset owners worldwide.

Tokenization is Charging Forward

The tokenization of real-world assets stands at the forefront of financial innovation, leveraging blockchain technology to offer a host of benefits and transforming how we think about ownership and investment. By enabling increased liquidity, fractional ownership, enhanced transparency, and reduced transaction costs, tokenization democratizes access to high-value assets and creates new opportunities for a wider range of investors.

However, the journey toward widespread adoption of tokenization is not without its challenges. Regulatory hurdles, technological risks, and market adoption barriers need to be carefully navigated to ensure the successful integration of tokenized assets into the global financial system. Despite these challenges, the successful case studies and ongoing innovations in the field signal a promising future for tokenization.

As tokenization continues to evolve, its impact on global financial markets will likely be profound. It has the potential to drive greater financial inclusion, increase market efficiency, and foster a more secure and transparent investment environment. Investors and asset owners alike should stay informed about the developments in this space and consider the opportunities and implications of tokenization for their investment strategies.

In the coming years, as blockchain technology and regulatory frameworks mature, tokenization is very likely to become a mainstream financial practice, reshaping the landscape of global finance and unlocking new possibilities for wealth creation and asset management. Embracing this transformative technology may well be the key to staying ahead in the rapidly evolving world of finance.