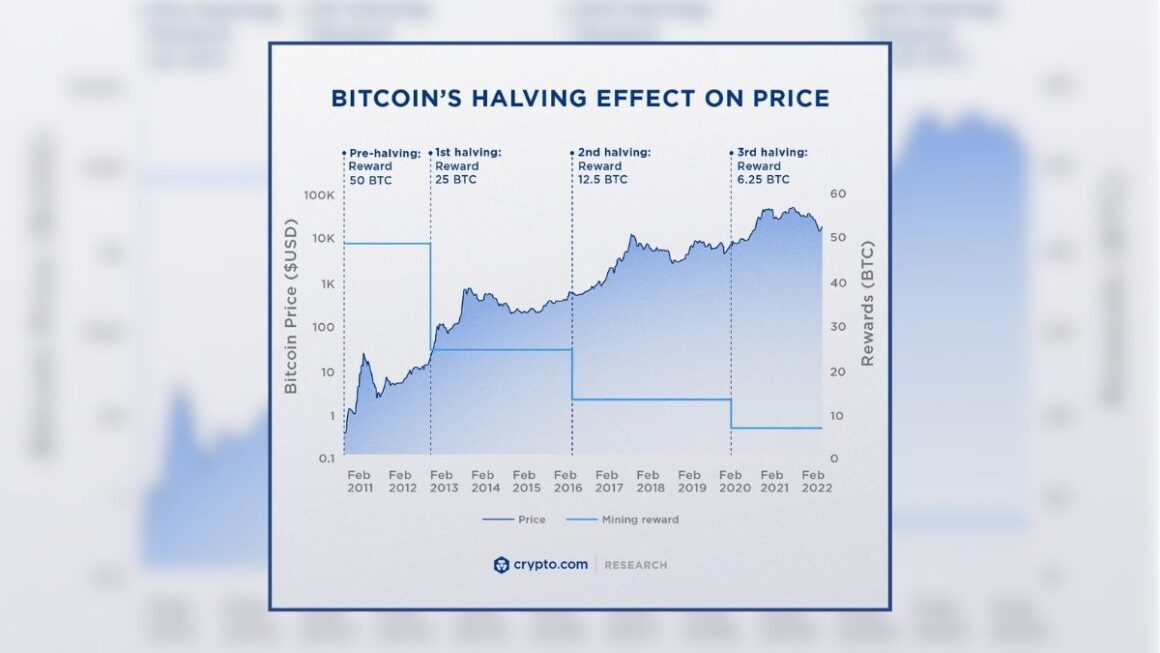

As investors, we have seen in the past that Bitcoin halving events have been pivotal moments in the scarcity-driven value model. These events spark excitement for their potential to increase digital wealth. Yet, they underscore the need for diligence, as the resulting market fluctuations could challenge those who are unprepared.

Bitcoin Halving, what is it? Let’s start with revisiting Bitcoin itself as the first and most popular cryptocurrency.

Bitcoin was created by an individual or group of people under the pseudonym of a legendary person named Satoshi Nakamoto. The true identity of Satoshi Nakamoto remains unknown. Nakamoto introduced Bitcoin in a 2008 white paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System” and released the first Bitcoin software in 2009.

Since its inception, Bitcoin has revolutionized the financial world. It operates on a technology called blockchain, which is a decentralized ledger containing all transaction data from anyone using Bitcoin.

Bitcoin’s decentralized nature means that it’s not controlled by any government or financial institution. This decentralization has made Bitcoin a popular choice for online transactions, and it’s even been adopted by some businesses as a form of payment. Transactions are added to “blocks” or the links of code that make up the chain, and each transaction must be recorded on a block.

We’re now going to go deeper down the rabbit hole to explain what Bitcoin halving is and its impact on scarcity and price.

What is Bitcoin Halving?

One of the most pivotal events on Bitcoin’s blockchain is a halving. This event happens approximately every four years and reduces the reward for mining bitcoin transactions by half. To understand the significance of a halving, it’s important to understand the process of Bitcoin mining.

Bitcoin mining is the process where people use their computers to participate in Bitcoin’s blockchain network as a transaction processor and validator. Bitcoin uses a system called proof-of-work (PoW) to validate transaction information. When a block is filled with transactions, it is closed and sent to a mining queue.

The halving is significant because it directly impacts the number of new bitcoins being generated and therefore the supply of bitcoins. This scarcity is one of the key reasons why Bitcoin has value.

Related: What Is DeFi and How Does It Transform Traditional Finance?

The Impact of Halving

The halving decreases the amount of new bitcoins generated per block. This means the supply of new bitcoins is lower, making buying more expensive. In normal markets, lower supply with steady demand usually leads to higher prices. Since the halving reduces the supply of new bitcoins, and demand usually remains steady, the halving has usually preceded some of Bitcoin’s largest runs.

However, it’s important to note that while the halving is expected to increase the price of Bitcoin, there are many other factors at play. These include technological changes, market demand, regulatory news, and macroeconomic trends.

Pre-Halving Price Trends

Before the halving events, Bitcoin has typically seen an increase in its price. The historical average of pre-halving price increases is about 23%. However, there have also been instances of price drops just months before the halving.

Post-Halving Price Trends

Following the halving, the average Bitcoin price increase has been around 28%. After the first halving in 2012, Bitcoin kicked off its first major bull run, surging from $13 to ~ $1,000. Similarly, robust recoveries were observed post-halving in 2016 and 2020

It’s important to note that these trends are historical and do not guarantee future price movements. Many factors can influence Bitcoin’s price.

When is the Next Bitcoin Halving?

The next Bitcoin halving is expected to take place in April 2024. It is difficult to predict the exact date as it depends on the block height. Since halving happens every 210,000 blocks, the next Bitcoin halving is expected to occur when the block height reaches 840,000.

There is a website that has an active countdown and an estimated time of arrival of the next Bitcoin Halving. You can find it here.

Preparing for the Next Halving

As we approach the next halving, it’s important to understand its potential impacts. Historically, the halving has led to significant price increases due to the reduced supply of new bitcoins. However, past performance is not indicative of future results, and it’s crucial to do your own research and consider multiple factors.

It’s also a good time to assess your investment strategy and goals. If you’re a long-term investor, you might choose to hold onto your Bitcoin and wait to see how the market reacts to the halving. If you’re a short-term trader, you might want to take advantage of potential price swings leading up to and following the halving.

Remember, this article is for informational purposes only and should not be considered financial advice. Always consult with a financial advisor before making investment decisions.

Related: Cryptocurrencies in 2024: Predictions and Trends

Looking Forward to Bitcoin Halving in 2024

Bitcoin and its halving offer a unique and dynamic element to the world of finance. As we approach the next halving in 2024, it’s an exciting time for investors, traders, and enthusiasts alike. Whether you’re new to the game or a seasoned pro, understanding the mechanics of Bitcoin and the impact of its halving is crucial to navigating the crypto landscape.

Bitcoin’s halving is a fundamental part of its design and has significant implications for its price. By understanding what the halving is and how it works, you can be better prepared for the next one in 2024. Whether you’re deep into Bitcoin or just starting out, it’s important to understand these core concepts to make informed decisions about your investments.

Objetive, agile and clear. Thanks and I look fordward for the next One.