The boomer housing wave is coming, with 9 million homes poised to reshape the current shortage in the housing market.

Imagine a tidal wave, not of water, but of homes—a vast and surging influx poised to redefine the landscape of the American housing market. This vision, underscored by a recent Freddie Mac study, isn’t the plot of a futuristic novel; it’s the impending reality we’re facing with the boomer housing phenomenon.

Key Takeaways

- Nearly 9 million Boomer homes are set to enter the market by 2035.

- Current forecasts may underestimate the impact of changing demographic behaviors.

- Millennials and Gen Z are key to absorbing the upcoming surge in housing availability.

Freddie Mac’s focused research on this group underscores the anticipated significant shift. This is especially significant as the residential real estate market has currently been grappling with an alarming shortage of single-family homes available for sale. This shortage has been exacerbated by rising interest rates and reduced home development activity.

Boomer Housing Impact: A Demographic Shift

The Baby Boomer generation, those born between 1946 and 1964, is at a pivotal juncture, with the youngest members turning 60 this year. As this influential cohort ages, their decisions, particularly regarding boomer housing, are set to have profound implications for both the U.S. economy and the housing market.

As the Baby Boomer generation embarks on the next phase of life, we’re on the brink of a monumental shift. Based on research by Freddie Mac, there will be “a gradual decline in the number of Boomer households. This dynamic will occur over time from around 32 million in 2022 to 23 million by 2035 as the oldest Boomers reach ages close to 90. “

Per this estimate, there will be approximately 9.2 million fewer Boomer homeowner households by 2035.

Related: 2024 Foreclosure Trends Increase, But Refinances Gain

Related: Uncovering the Reality of the Feb 2024 Home Sales Data

The Reality Behind the Numbers

However, the looming “silver tsunami,” a term once used to describe the expected flood of homes hitting the market as Boomers downsize or make other living arrangements, might more aptly be termed a steady tide.

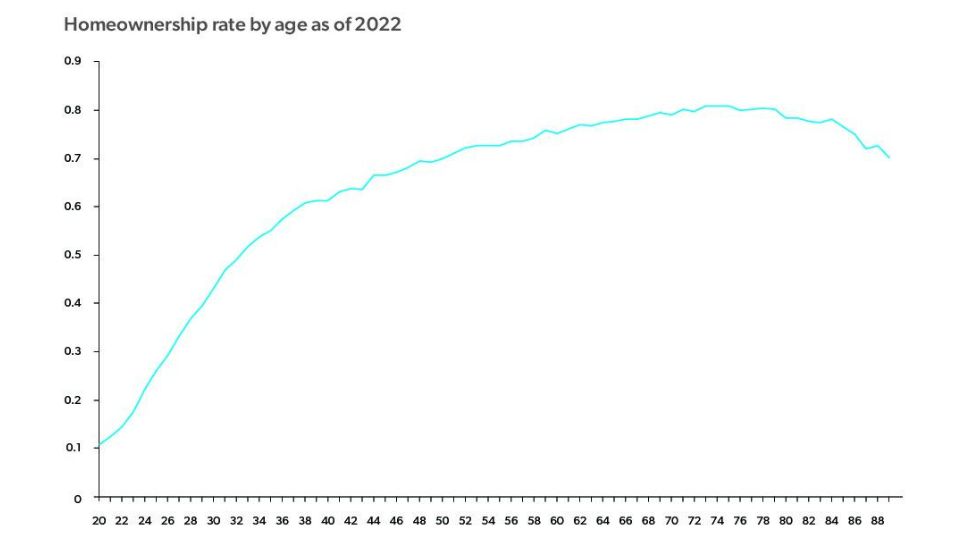

Currently, Boomers represent 21% of the U.S. population and hold 38% of all homeowner households. This figure underscores their significant overrepresentation in the homeowner demographic. This is largely because homeownership rates typically climb as people age, reaching a plateau before starting to decline after the age of 75.

The chart below shows very low homeownership (10% – 30%) for people in their 20’s. Contrast this with the high homeownership rate (70% – 80%) for those aged in their 60’s, 70’s, and even in their 80’s.

While Freddie Mac’s analysis suggests a measured, gradual influx of boomer housing into the market, the unfolding reality may diverge significantly from these predictions.

The foundation of their forecasts—historical retention rates—might not fully capture the nuances of the current era. With advancements in retirement healthcare and increases in life expectancy, older Americans are enjoying longer, more active lives.

This shift suggests that if we were to apply the retention rates of the most recent cohorts, observed as of 2022, the anticipated reduction in Boomer households by 2035 could be markedly less If this were to happen, it would potentially narrow to a decrease of only one million homes, a figure substantially lower than initially projected.

Related: The Top 10 Types of Home Loans

Boomer Housing and the Next Generation’s Response

The potential discrepancy underscores a dynamic and unpredictable boomer housing market. While the passage of time affects us all, the demographic landscape is continually refreshed by younger generations.

Beyond the natural demographic turnover, there’s a burgeoning, yet unmet, demand for housing, particularly among Millennials. Freddie Mac’s October 2023 Outlook highlighted an estimated two million additional potential households within this generation alone.

Coupled with contributions from Gen Z, the overall demand for housing is expected to climb in the coming years, despite the gradual departure of Boomers from the homeowner stage.

This scenario suggests a more complex boomer housing trend than a simple case of supply and demand. Over the next five years, the surge in homeownership among young adults could significantly counterbalance, if not exceed, the decline in Boomer homeowner households.

Such a development would not only challenge Freddie Mac’s initial forecasts but also introduce a new layer of complexity to the housing market, hinting at a future where the anticipated “gradual” shift might unfold with unexpected dynamics.

With the potential for unexpected twists in the tale, as younger generations step forward to meet this 9 million home wave, the landscape of the American housing market is set for a redefinition.