The journey into homeownership is often exciting, yet it comes with complex and significant financial aspects. Understanding residential real estate finance is essential for any potential homeowner or investor. In this comprehensive guide, we will navigate the fundamental concepts of financing a home.

Introduction to Residential Real Estate Finance

Real estate finance refers to the means by which individuals or businesses fund the purchase of residential property. It involves evaluating loan options, understanding interest rates, and managing long-term payments. It is the backbone of the housing market, enabling millions to own homes without the immediate capital to buy outright.

A mortgage is a loan specifically designed for purchasing property. It is typically the largest financial commitment one will undertake. The borrower agrees to pay back the borrowed amount, plus interest, over a predetermined period. Mortgages come in various forms, each with unique terms and conditions to suit different buyers.

Types of Mortgage Loans

Mortgage loans come in various types, each with unique features, qualifications, and purposes, catering to different financial needs and circumstances. Here’s a more detailed look at the common types:

- Conventional Loans: These are the most common type of mortgages. They are not insured by the federal government and typically require a higher down payment, often around 20%. However, borrowers with strong credit can sometimes qualify for a lower down payment. Conventional residential real estate finance loans are further divided into two types:

- Conforming Loans: These loans adhere to the guidelines set by Fannie Mae and Freddie Mac, including limits on the maximum loan amount.

- Non-Conforming Loans: These loans do not meet the criteria set by Fannie Mae and Freddie Mac, often because the loan amount is higher than the set limit. These are also known as jumbo loans.

- Government-Insured Loans: These loans are backed by the government and usually offer more lenient qualification requirements and lower down payments.

- FHA Loans: Insured by the Federal Housing Administration, FHA loans are designed for low-to-moderate income borrowers. They require a lower minimum down payment and have more lenient credit score requirements.

- VA Loans: Guaranteed by the Department of Veterans Affairs, these loans are available to veterans, service members, and their spouses. VA loans offer benefits like no down payment and no private mortgage insurance (PMI).

- USDA Loans: Insured by the U.S. Department of Agriculture, these loans are designed to aid rural development and are available to homebuyers in rural and some suburban areas. They often require no down payment.

- Fixed-Rate Mortgages: These loans have a fixed interest rate for the entire term of the loan, which typically ranges from 15 to 30 years. The main advantage is that the monthly payments remain consistent, making budgeting easier.

- Adjustable-Rate Mortgages (ARMs): ARMs begin with a fixed interest rate for a set period and then the rate adjusts periodically based on market conditions. These residential real estate finance loans can be attractive due to lower initial interest rates but carry the risk of increasing rates and payments over time.

- Interest-Only Mortgages: In these loans, borrowers pay only the interest for a certain number of years, after which they start paying off the principal. This can lead to lower initial payments but higher payments later on.

- Balloon Mortgages: These involve small payments for a set period, followed by a large lump-sum payment to pay off the remaining balance. They can be risky as borrowers need to ensure they can make the large final payment.

- Reverse Mortgages: Aimed at seniors, these allow homeowners to convert part of their home equity into cash income without having to sell the home. The loan is repaid when the borrower moves out or passes away.

Each type of mortgage loan has its advantages and disadvantages, and the right choice depends on the borrower’s financial situation, future plans, and risk tolerance. It’s important for potential homeowners to research and understand these options before making a decision.

The Role of Credit in Residential Real Estate Finance

Credit scores are a critical factor in the home financing process, significantly influencing both the eligibility for a mortgage and the terms of the loan, including interest rates. Here’s an expanded explanation:

- Role in Mortgage Eligibility:

- Determining Loan Approval: Residential real estate finance lenders use credit scores as a primary tool to assess a borrower’s creditworthiness. A higher credit score generally indicates a history of responsible credit management, suggesting a lower risk of default. Consequently, a high credit score can greatly increase the likelihood of mortgage approval.

- Type of Mortgage: Your credit score can also determine the type of mortgage loans you are eligible for. For example, conventional loans typically require a higher credit score compared to government-insured loans like FHA loans.

- Influence on Interest Rates:

- Rate Variations: Residential real estate finance lenders offer different interest rates based on the perceived risk associated with lending money. A higher credit score often qualifies borrowers for lower interest rates, as it suggests a lower likelihood of default. Conversely, a lower credit score can lead to higher interest rates, significantly increasing the overall cost of the loan.

- Long-Term Financial Impact: Even a slight difference in interest rates can have a substantial impact on the total amount paid over the life of the loan. A lower rate not only reduces monthly payments but also decreases the total interest paid.

- Impact on Loan Terms:

- Favorable Terms: Besides influencing interest rates, a good credit score can lead to more favorable loan terms, such as a lower down payment requirement, fewer fees, or more flexible repayment options.

- Loan Amount: A higher credit score may also increase the amount a lender is willing to finance, potentially allowing for the purchase of a higher-priced home.

- Maintaining Good Credit:

- Building and Repairing Credit: It’s important for prospective homebuyers to actively build and maintain their credit. This can be achieved through timely bill payments, keeping credit card balances low, and avoiding excessive new credit inquiries or debts.

- Monitoring Credit Reports: Regularly checking credit reports for errors and addressing any inaccuracies is also vital. Mistakes on a credit report can unjustly lower a credit score and negatively affect mortgage terms.

- Planning Ahead:

- Long-Term Strategy: Prospective homebuyers should start focusing on their credit scores well in advance of applying for residential real estate finance loan. Improving credit can take time, so early and consistent attention to credit health is crucial.

- Seeking Professional Advice: Consulting with financial advisors or mortgage specialists can provide guidance on how to improve credit scores and prepare financially for a home purchase.

In summary, a credit score is not just a number but a key element that shapes the home financing landscape. It affects everything from loan eligibility to the cost of borrowing. Prospective homebuyers should regard maintaining or improving their credit score as an essential step in their journey toward homeownership.

The Down Payment

The down payment is the initial, upfront portion of the purchase price paid by the buyer. It demonstrates the buyer’s commitment and reduces the lender’s risk. Traditional mortgages usually require a down payment of 20%, but certain residential real estate finance loans may allow for a smaller percentage, sometimes as low as 3.5%.

Residential Real Estate Finance Interest Rates Explained

Interest rates are a pivotal factor in the home-buying process, as they directly impact the cost of borrowing money. These rates vary based on broader economic trends, central bank policies, and individual borrower characteristics. Here’s an expanded view of how interest rates affect home loans:

- Market Trends and Economic Factors:

- Economic Health: Interest rates are influenced by the overall health of the economy. In a robust economy, residential real estate finance rates tend to be higher as there’s more demand for credit. Conversely, in a slower economy, rates may be lowered to encourage borrowing and stimulate economic activity.

- Central Bank Policies: Rates are also impacted by the policies of central banks, like the Federal Reserve in the United States. These institutions adjust rates to control inflation and stabilize the economy.

- Global Events: Global economic events, such as financial crises or pandemics, can lead to fluctuations in interest rates as governments and central banks respond to these challenges.

- Borrower’s Creditworthiness:

- Credit Score Impact: A borrower’s credit score plays a crucial role in determining the interest rate they are offered. Higher credit scores generally lead to lower interest rates, as they indicate a lower risk of default.

- Debt-to-Income Ratio: Lenders also consider a borrower’s debt-to-income ratio. A lower ratio can lead to more favorable interest rates, as it suggests the borrower is not overextended financially.

- Fixed-Rate Mortgages (FRMs):

- Rate Stability: FRMs lock in an interest rate for the entire term of the loan, which can range from 10 to 30 years. This provides predictability in monthly payments, shielding borrowers from interest rate fluctuations.

- Long-Term Planning: Fixed rates are ideal for borrowers who plan to stay in their home for a long time and prefer consistent payments, regardless of market conditions.

- Adjustable-Rate Mortgages (ARMs):

- Initial Lower Rates: ARMs typically start with lower interest rates than FRMs, making them attractive in the short term.

- Periodic Adjustments: The interest rate on an ARM changes over time, usually in relation to an index rate. This means monthly payments can increase or decrease.

- Rate Caps: ARMs generally have rate caps that limit how much the interest rate can change in a given period and over the life of the loan.

- Choosing the Right Type:

- Risk Tolerance: The choice between a fixed-rate and an adjustable-rate mortgage often depends on the borrower’s risk tolerance and financial situation. Those comfortable with the possibility of rising rates might opt for an ARM, while those who prefer stability might choose a fixed-rate mortgage.

- Market Forecast: Understanding current market trends and future forecasts can also guide borrowers in choosing the type of mortgage that aligns with their financial goals.

In essence, interest rates are a key element in determining the affordability of a mortgage. They vary based on economic conditions, central bank policies, and individual borrower profiles.

Borrowers must consider their financial situation, risk tolerance, and long-term housing plans when choosing between fixed-rate and adjustable-rate mortgages. Being informed about how these residential real estate finance rates work and how they are affected by various factors can help borrowers make the best decision for their financial future.

Related: The Top 10 Types of Home Loans

The Loan Amortization Schedule

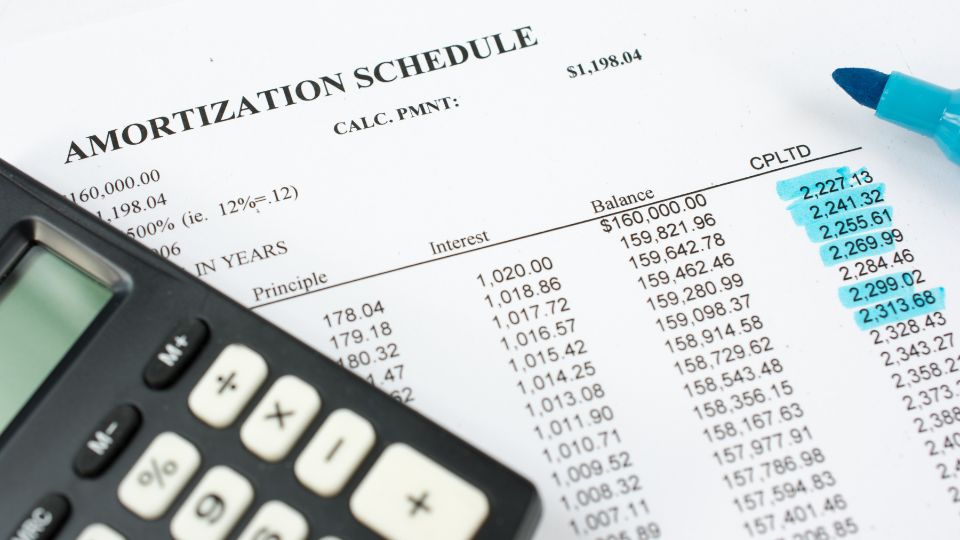

A loan amortization schedule provides a detailed breakdown of how each payment is divided between interest and principal over the life of a loan. Initially, a greater portion of each payment is dedicated to interest, reflecting the lender’s charge for borrowing the money.

As the loan matures, this dynamic shifts, with a larger portion of each payment reducing the principal balance. The interest charged decreases over time since it’s calculated on the remaining principal, which is gradually reduced with each payment.

This schedule is essential for understanding the progression of residential real estate finance loan repayments. Early in the loan term, the principal balance decreases slowly as most of the payment covers interest. Over time, more of each payment is applied to the principal, increasing home equity more rapidly.

It also aids in making informed decisions, like evaluating the benefits of additional payments, early payoff, or refinancing. For borrowers, the amortization schedule is a transparent guide that shows how each payment contributes to paying down the loan, aiding in effective financial planning.

Mortgage Pre-approval and Pre-qualification

Pre-qualification is an initial step to gauge how much one might afford, while pre-approval is more rigorous. Obtaining pre-approval for a mortgage significantly strengthens a buyer’s position, showing sellers that they are serious and financially capable. It involves a thorough check of credit history, income, and assets.

Homebuyers can avoid significant delays and headaches in residential real estate finance transactions by simply applying for pre-approvals. Mortgage brokers can provide great value to homebuyers in this area as they are connected to a variety of residential real estate finance lenders.

The Impact of Loan-to-Value Ratio

The loan-to-value ratio (LTV) is a risk assessment tool used by lenders to evaluate the mortgage amount against the home’s value. A lower LTV means more equity in the home, posing less risk to the lender. High LTVs may necessitate private mortgage insurance, adding to the monthly payment.

Related: Boomer Housing’s Surging Wave: 9 Million Homes Incoming

Real Estate Financing Costs

Real estate financing involves various costs and fees beyond the mortgage itself, and the industry is subject to comprehensive regulations aimed at protecting consumers. Here’s an expanded look at these aspects:

- Additional Costs in Residential Real Estate Finance:

- Closing Costs: These are expenses over and above the price of the property. They can include:

- Origination Fees: Charged by the lender for processing the new loan application.

- Title Insurance: Protects the lender and buyer from any losses incurred from disputes over the property’s ownership.

- Appraisal Fees: Paid to assess the property’s fair market value.

- Legal Fees: For attorney services, if required, during the transaction.

- Inspection Costs: For professional inspection of the property to identify any issues.

- Ongoing Expenses:

- Property Taxes: These are levied by the local government and vary depending on the property’s location and value.

- Homeowners’ Insurance: Required to protect against damages and losses to the property and assets within it.

- Maintenance and Repairs: Regular upkeep is necessary to maintain the property’s condition and value.

- Closing Costs: These are expenses over and above the price of the property. They can include:

- Regulations in Residential Real Estate Finance:

- Dodd-Frank Wall Street Reform and Consumer Protection Act: Enacted in response to the 2008 financial crisis, this act brought significant changes to residential real estate finance, including:

- Increased Transparency: Requires lenders to provide clearer disclosures to borrowers about loan terms and risks.

- Consumer Protection: The Consumer Financial Protection Bureau (CFPB), enforces rules to protect consumers in financial transactions.

- Risk Retention: Requires lenders to retain a portion of the risk in the mortgages they underwrite, encouraging responsible lending.

- Other Regulatory Measures: These might include:

- Truth in Lending Act (TILA): Requires lenders to disclose the terms and costs of a loan to consumers.

- Real Estate Settlement Procedures Act (RESPA): Ensures transparency in residential real estate finance transactions and prohibits kickbacks and referral fees that increase costs for consumers.

- Dodd-Frank Wall Street Reform and Consumer Protection Act: Enacted in response to the 2008 financial crisis, this act brought significant changes to residential real estate finance, including:

- Impact of Regulations:

- Consumer Safeguards: These regulations are designed to safeguard consumers from predatory lending practices and to ensure they are well-informed about the costs and obligations of their loans.

- Market Stability: By promoting responsible lending and borrowing practices, these regulations aim to maintain the stability of the real estate market and prevent the kinds of risky practices that led to the 2008 financial crisis.

Purchasing a home involves various costs beyond the principal and interest payments of the mortgage. Understanding these additional expenses, such as closing costs, taxes, and insurance, is crucial for prospective homeowners. Additionally, the residential real estate finance industry is heavily regulated to protect consumers and maintain market integrity. Legislation like the Dodd-Frank Act plays a vital role in promoting transparency, accountability, and consumer protection in the realm of real estate finance.

The Importance of Property Appraisal

A property appraisal is a key component in residential real estate finance transactions. Conducted by a certified appraiser, this assessment determines the current market value of a home based on a variety of factors. Appraisers consider the property’s location, size, condition, and recent sales of comparable properties in the area. They also take into account unique features of the home, such as any upgrades or renovations that have been made. This thorough evaluation ensures that the estimated value reflects the true worth of the property in the current market.

The appraisal serves a dual purpose in the home buying and financing process. For lenders, it provides assurance that they are not lending more money than the home is worth. This is crucial because the property serves as collateral for the mortgage; if the borrower defaults, the lender needs to be sure that they can recoup their investment by selling the property. For buyers, an appraisal helps ensure that they are not overpaying for the property. It offers a form of protection by aligning the loan amount with the actual value of the home, preventing scenarios where the buyer owes more on the mortgage than the home is worth.

In addition to its role in initial financing, an appraisal can be important in refinancing situations. When homeowners look to refinance their mortgage, the lender will often require a new appraisal to ensure the loan amount is still in line with the home’s value. This can be particularly important if property values in the area have changed significantly.

Trends in housing values are very significant in making residential real estate finance decisions. The future values of residential properties are hard to predict. However, some thought behind possible trends may help homeowners avoid pitfalls down the road.

Understanding Private Mortgage Insurance (PMI) in Residential Real Estate Finance

PMI, or Private Mortgage Insurance, is an additional cost for residential real estate finance borrowers who do not make a substantial down payment on their home purchase. Typically, when a borrower makes a down payment of less than 20% of the home’s purchase price, lenders require PMI to protect themselves against the increased risk of loan default.

This is particularly relevant for high Loan-to-Value (LTV) ratio loans, where the loan amount constitutes a significant portion of the home’s value. The rationale behind this requirement is that borrowers with less financial investment in the property (i.e., a smaller down payment) are perceived as more likely to default on their mortgage.

The cost of PMI varies depending on several factors, such as the size of the down payment, the loan amount, and the borrower’s credit score. It is typically included in the monthly mortgage payment and can range from 0.3% to 1.5% of the original loan amount per year.

Although PMI increases the monthly housing cost for the borrower, it enables many individuals to become homeowners who otherwise might not qualify due to the inability to make a large down payment. For these borrowers, PMI is a tool that facilitates homebuying, despite the added expense.

Importantly, PMI is not a permanent part of the mortgage payment in residential real estate finance. It can be removed once the homeowner reaches a certain level of equity in the property, usually when the mortgage balance falls to 80% or less of the home’s original appraised value or purchase price. Homeowners can achieve this either through regular mortgage payments that reduce the principal balance, an increase in the property’s value, or a combination of both.

In some cases, homeowners may request the cancellation of PMI when they reach 20% equity, while in others, PMI is automatically removed once the balance reaches 78% of the original value. Keeping track of home equity and understanding the terms of PMI removal can help homeowners reduce their monthly expenses once they have sufficiently invested in their property.

Refinancing Your Mortgage

Refinancing a mortgage involves replacing an existing loan with a new one, often to secure a lower interest rate. It can reduce monthly payments, shorten the loan term, or allow for cashing out equity. However, it comes with costs, so the benefits must outweigh the expenses.

Refinancing can also provide flexibility in managing personal finances. For instance, homeowners might choose to refinance to switch from an adjustable-rate mortgage to a fixed-rate mortgage, offering more predictable and stable monthly payments.

This is particularly beneficial in a rising interest rate environment, where locking in a lower fixed rate can protect against future rate increases. Additionally, refinancing can be used to consolidate debts, by using the home’s equity to pay off high-interest debts like credit cards, thereby streamlining finances and potentially reducing overall monthly payments.

However, it’s important to consider the break-even point when refinancing. This is the point at which the savings from the new loan exceed the costs of refinancing. These residential real estate finance costs can include application fees, origination fees, appraisal fees, and other closing costs.

Homeowners should calculate how long it will take to recoup these expenses through the savings gained from the lower interest rate or reduced loan term. If the homeowner plans to move or sell the house before reaching the break-even point, refinancing might not be a financially sound decision.

Understanding the total costs and long-term financial impact is crucial for making an informed decision about whether refinancing is the right choice.

Related: HELOC Loans: Understanding Home Equity Lines of Credit

Tax Benefits of Homeownership and Residential Real Estate Finance

Homeownership offers several tax advantages that can enhance its long-term affordability. One of the most significant benefits is the ability to deduct mortgage interest from taxable income. This deduction is particularly valuable in the initial years of a mortgage when the interest portion of the payment is higher. The Internal Revenue Service (IRS) allows homeowners to deduct interest on a portion of their residential real estate finance debt, subject to certain limits. This deduction can lead to substantial tax savings, especially for those in higher tax brackets or with sizeable mortgage loans.

Another key tax benefit for homeowners is the deduction of property taxes. This allows homeowners to deduct the property taxes paid each year on their primary residence and any other real estate they own. By reducing the homeowner’s overall taxable income, these deductions can result in significant tax savings over the life of the mortgage. This makes owning a home more financially attractive compared to renting, where such tax benefits are not available.

Homeowners may also enjoy capital gains exclusion when selling their primary residence. Under certain conditions, a portion of the profit from the sale of the home can be excluded from federal income tax. This exclusion amount is substantial, offering a significant tax break to homeowners who meet the eligibility criteria.

It’s important for homeowners to stay informed about tax laws and consult with tax professionals, as tax benefits can vary based on individual circumstances and are subject to changes in legislation. Overall, the tax advantages associated with homeownership, including deductions for mortgage interest and property taxes, as well as capital gains exclusion, can substantially reduce taxable income and contribute to the affordability of owning a home over the long term.

The Path to Homeownership

Financing a home is a multifaceted process that requires careful consideration of many residential real estate finance components. From choosing the right type of mortgage to understanding interest rates and managing credit, each element plays a vital role in the journey to homeownership. With the right knowledge and planning, prospective homeowners can navigate the world of real estate finance and make their dream of owning a home a reality.

The landscape of residential real estate finance is continuously evolving with technology and regulatory changes. Innovations like online mortgage platforms have streamlined the application process. Furthermore, emerging lending models and regulatory adjustments could reshape financing options available to future homebuyers.