2024 Foreclosure Trends reveal a complex scenario with home refinances slightly up but foreclosure rates on the rise.

In the latest U.S. Foreclosure Market Report for February 2024, ATTOM, a data curator for real estate, unveiled figures that paint a nuanced picture of the current state of foreclosure activity across the United States.

Understanding 2024 Foreclosure Trends

According to the report, there were 32,938 U.S. properties facing foreclosure filings, including default notices, scheduled auctions, or bank repossessions. This represents a slight decrease of 1 percent from the previous month but marks an 8 percent increase compared to the same period last year.

The data suggests a subtle yet noticeable shift in the foreclosure landscape. This is indicative of broader trends within the housing market. A look at the broader residential real estate market portends upcoming changes in the economic conditions affecting homeownership.

Rob Barber, CEO of ATTOM, commented on these early 2024 foreclosure trends. He, highlighted the importance of understanding these current market conditions. “The annual uptick in U.S. foreclosure activity hints at shifting dynamics within the housing market,”

Barber said. “These trends could signify evolving financial landscapes for homeowners, prompting adjustments in market strategies and lending practices. We continue to closely monitor these trends to comprehend their complete effect on foreclosure activity.”

Related: The Top 10 Types of Home Loans

Regional and Statewide Variations in Foreclosure Activity

The landscape of the U.S. housing market, as reflected in the 2024 foreclosure trends, reveals a complex picture of decreases and increases in foreclosure completions across the nation.

In February 2024, lenders repossessed 3,397 properties through completed foreclosures, marking a significant decrease from both the previous month and the same period last year. This downward trend was notably apparent in states like Georgia, New York, North Carolina, New Jersey, and Maryland, each witnessing a substantial annual decrease in foreclosure completions.

Contrarily, some states bucked the national downward trend, showing notable annual increases in foreclosure completions, with South Carolina, Missouri, Pennsylvania, Texas, and Indiana leading this countermovement.

This variance underscores the localized nature of foreclosure impacts, with certain areas feeling the economic pressures more acutely.

Metropolitan areas also displayed a significant range in foreclosure activity, with cities such as Chicago, Philadelphia, New York, Pittsburgh, and Detroit experiencing the highest numbers of repossessions.

Meanwhile, states like South Carolina, Delaware, and Florida recorded the highest foreclosure rates, pointing to a continued vulnerability in certain geographic regions.

Related: Uncovering the Reality of the Feb 2024 Home Sales Data

The national average saw one in every 4,279 housing units facing a foreclosure filing in February 2024, with metropolitan areas in South Carolina, Florida, and California showcasing particularly high foreclosure rates.

This geographical diversity in foreclosure activity highlights the varied economic factors at play across the U.S., shaping the overall 2024 foreclosure trends and affecting homeowners in different ways.

Related: HELOC Loans: Understanding Home Equity Lines of Credit

The Refinancing Response to 2024 Foreclosure Trends

As we delve deeper into the narrative of 2024 foreclosure trends, a recent development offers a glimmer of hope for some homeowners amid broader market challenges.

Despite the overarching downturn in mortgage originations witnessed over the past years, a notable uptick in refinancing activity has emerged, providing a temporary respite for certain homeowners.

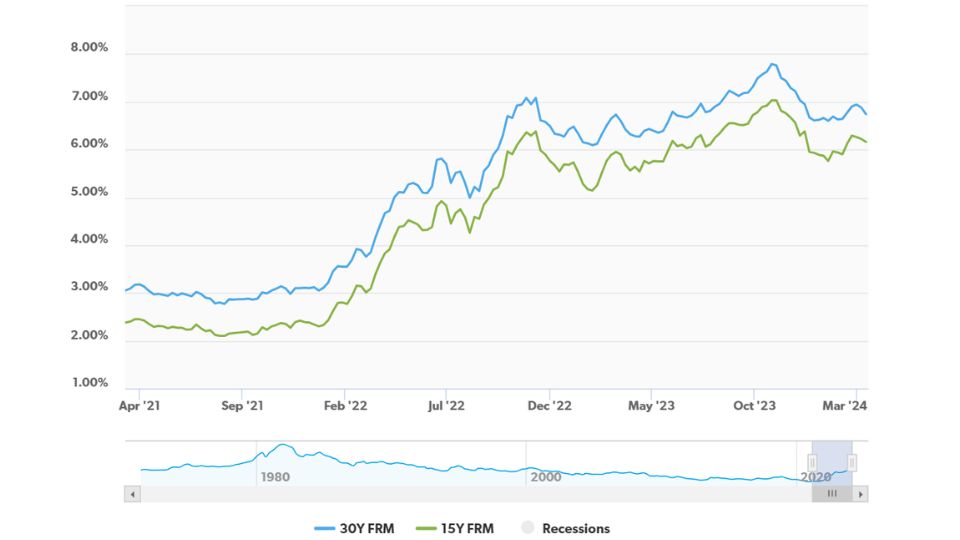

This shift comes as mortgage rates begin to retreat from their peak near 7%, offering a fleeting opportunity for rate-sensitive borrowers. The average rate on the 30-year fixed mortgage recently dropped to 6.74%, a decline from 6.88% the week prior, signaling a near quarter-percent decrease in just two weeks, according to Freddie Mac.

This easing of rates sparked a surge in refinance interest, with homeowners seizing the chance to lower their mortgage payments or consolidate other debts.

The Mortgage Bankers Association reported a 12% increase in refinance applications for the week ending March 8, reaching a level 5% above the same period last year. This resurgence in refinancing, particularly a 24% spike in government refinance applications, underscores the immediate response of homeowners to favorable rate movements.

Related: Boomer Housing’s Surging Wave: 9 Million Homes Incoming

The Broader Impact of Mortgage Rate Changes

Despite this optimistic uptick in refinancing, the overall landscape of home mortgage originations remains subdued compared to previous years.

The fourth quarter of the last year marked a continued decline in mortgage activity, reflecting broader economic and housing market pressures, including elevated home prices, high mortgage rates, and scarce housing inventory.

Moreover, with inflation still presenting a hotter-than-expected figure, indications suggest that mortgage rates may rise again in the coming weeks, potentially closing the current window for refinancing opportunities.

This recent trend in refinancing is a critical component of the evolving 2024 foreclosure trends narrative. It highlights how momentary shifts in mortgage rates can offer temporary relief for homeowners, even as the broader market continues to grapple with challenges.

However, it’s important to note that the pool of homeowners who can truly benefit from the current rates is limited. With around 89% of homeowners with a mortgage carrying a rate under 6% as of January, the scope for benefiting from the current lower rates is relatively narrow, underscoring the nuanced and complex nature of the current housing market finance dynamics.