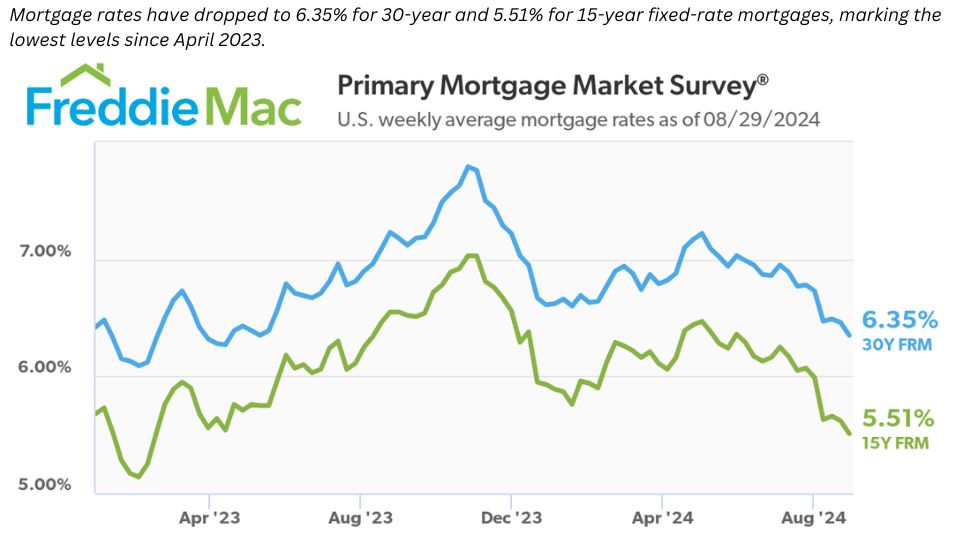

As low mortgage rates hit levels not seen in over a year, many prospective homebuyers and refinancers are finally starting to come out of the woodwork. Rates are now hovering around 6.35% for a 30-year fixed-rate mortgage, down from their recent highs and many are wondering where we are headed for the rest of 2024.

Rates at a 16-Month Low: From the Peaks to the Low Mortgage Rates

In April 2023, low mortgage rates reached a point that offered significant opportunities for homebuyers. However, this low was short-lived, as rates began a steady climb in the following months. Economic factors, including persistent inflation, aggressive rate hikes by the Federal Reserve, and global market uncertainties, contributed to this increase.

As inflation began to accelerate in mid-2023, the Federal Reserve responded with a series of interest rate hikes aimed at controlling rising prices. These hikes, though necessary to curb inflation, had the unintended consequence of pushing mortgage rates higher. Homebuyers and refinancers found themselves facing rates that were often prohibitive, leading to a significant cooling in the housing market.

The rising rates we saw post-April 2023 were a direct response to inflationary pressures and the Fed’s efforts to cool down the economy. As inflation began to moderate, and the economy showed signs of stabilization, it set the stage for rates to gradually come back down.

The impact of these rising rates was felt across the housing sector. Home sales slowed, particularly among first-time buyers who were most sensitive to higher borrowing costs. The refinancing market also took a hit, with fewer homeowners able to justify the costs associated with refinancing at higher rates.

Why Rates Are Falling Again

So, what has changed? The recent dip in low mortgage rates can be attributed to several key factors. First, inflation has shown signs of cooling, with the latest reports indicating that price pressures are beginning to ease. This has alleviated some of the need for aggressive monetary policy, allowing the Federal Reserve to adopt a more cautious approach to future rate hikes.

The Federal Reserve’s more dovish tone has been a significant driver of the recent decline in mortgage rates. As the central bank signals a slowdown in the pace of rate hikes, lenders have responded by lowering mortgage rates in anticipation of a more stable economic environment. Additionally, recent data showing improvements in the labor market and consumer confidence have bolstered the outlook for the economy, further supporting the case for lower rates.

We’re seeing a natural correction in the market. As economic conditions improve and the Fed signals a more measured approach to monetary policy, we expect mortgage rates to reflect these changes, benefiting borrowers.

Global economic conditions have also played a role. As geopolitical tensions have eased and global markets have stabilized, there has been less demand for safe-haven assets like U.S. Treasury bonds, which are closely tied to mortgage rates. The decrease in bond prices has led to a corresponding drop in yields, which has allowed mortgage rates to decline.

Related: Mortgage Applications Surge by 16.8% in August

How Homebuyers and Refinancers Can Benefit

For those considering buying a home or refinancing an existing mortgage, the current environment of low mortgage rates offers a unique opportunity. Here’s how you can make the most of it:

- Lock in Your Rate: With rates currently at a 16-month low, it’s an excellent time to lock in a mortgage rate. Even if you’re not ready to close on a home purchase immediately, locking in a rate can protect you from potential future increases. Many lenders offer rate-lock options that allow you to secure today’s rate for a set period, giving you peace of mind as you shop for a home.

- Consider Refinancing: If you have an existing mortgage with a higher interest rate, now might be the perfect time to refinance. Even a slight reduction in your rate can lead to significant savings over the life of the loan. For example, lowering your rate by just 0.5% could save you thousands of dollars in interest payments over the term of a 30-year mortgage. Be sure to compare offers from multiple lenders to ensure you’re getting the best deal.

- Explore Different Loan Options: With rates varying across different loan types, it’s worth exploring whether a 15-year fixed-rate mortgage or an adjustable-rate mortgage (ARM) could offer you even better terms. A 15-year mortgage typically comes with a lower interest rate than a 30-year loan, which could save you money on interest, though your monthly payments will be higher. ARMs, on the other hand, start with a lower rate for an initial period, which could be beneficial if you plan to sell or refinance before the rate adjusts.

- Build Your Financial Profile: Now is also a good time to ensure your financial profile is as strong as possible. Lenders offer the best rates to borrowers with excellent credit scores, stable income, and low debt-to-income ratios. Take steps to improve your credit score by paying down debts, avoiding new credit inquiries, and ensuring your credit report is accurate.

- Consult with an Advisor: Before making any decisions, it’s crucial to speak with a financial advisor, mortgage broker, or banker who can help you assess your options. They may be able to help you determine the best course of action based on your financial situation. An advisor can also help you understand the long-term implications of your mortgage choices and how they fit into your broader financial plan.

Looking Ahead: What to Expect from Mortgage Rates

While the current dip in low mortgage rates is certainly welcome news for homebuyers and refinancers, it’s important to keep in mind that the market is always subject to change. Economic conditions can shift rapidly, and what seems like a stable trend today could reverse tomorrow.

As we move into the latter part of 2024, keep an eye on key economic indicators like inflation, employment figures, and Federal Reserve announcements. These factors will play a significant role in determining the direction of mortgage rates.